May 2015

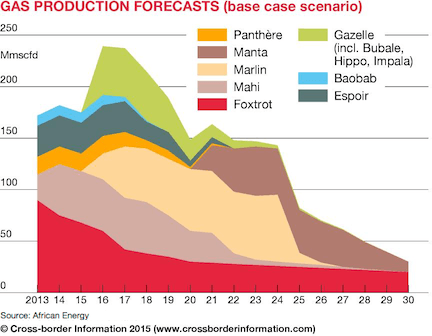

The conversion of existing IPPs to CCGT provides a welcome boost in electricity generation for a system already dependent on costly liquid fuel as backup, but declining domestic gas production and sustained electricity demand growth of 7%/yr open up opportunities for LNG imports to help plug a potential future electricity supply deficit, African Energy research shows

Electricity demand growth in Côte d’Ivoire has accelerated in recent years, at a sustained 6% in the 2000s and rising to 7% since the resolution of the 2011 political crisis. As of 2013, electricity demand was 1,077MW, according to the state electricity regulator Autorité Nationale de Régulation du Secteur de l'Electricité (Anaré). Total national electricity demand (on- and off-grid) is expected to reach 8,146GWh in 2015.

To meet the growing electricity demand, installed generation capacity has risen from 615MW in 1995 to 1,627MW as of February 2015. From a largely hydroelectric-dominated energy mix, Côte d’Ivoire has diversified, and generation capacity now largely utilises domestic reserves of natural gas.

Generation supplied to consumers falls slightly short of total demand. In 2013 on-grid power plants generated 7,582GWh, according to Anaré, with around 5,000GWh supplied to customers and 820GWh exported to Société Nationale d'Electricité du Burkina Faso (Sonabel), Communauté Electrique du Bénin (CEB), Ghana's Volta River Authority (VRA), and Énergie du Mali (EdM).

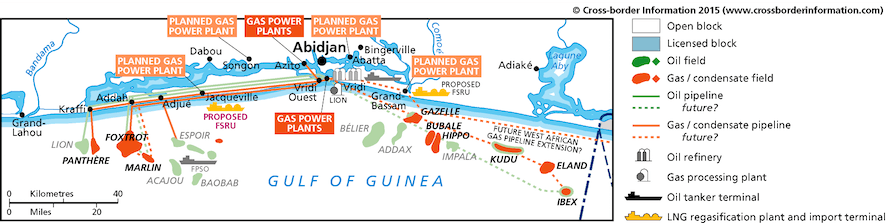

Further expansion works are planned to keep up with increasing electricity demand. Compagnie Ivoirienne de Production d'Electricité (Ciprel)’s 432MW gas-fired power plant at Vridi is due to complete its conversion to combined cycle gas turbine operation in 2015, while conversion of Globeleq’s 288MW Azito plant is expected shortly after. Meanwhile, a new 270MW hydroelectric power plant at Soubré is under construction by China’s Sinohydro and financed by the Export-Import Bank of China. In the short term, Aggreko has supplied 200MW of rental power, under a contract extended for a further three years in January 2015.

Should electricity demand continue at 7%, Côte d’Ivoire will see peak on-grid demand of an estimated 13,500GWh in 2025, requiring total installed capacity of 2,500MW. But Côte d’Ivoire has grander plans, and is aiming for 3,000MW of installed capacity by 2025 in order to meet much more aggressive growth in the mining sector – which the government believes could potentially be as much as 500MW by 2020 – as it pushes to maximise its natural resource potential and diversify the economy away from agriculture.

The government has set out plans to meet this expected increased electricity demand. Six new gas-fired power plants totalling 2,000MW are planned for completion over the coming decade. However, as yet limited progress has been made, largely due to Côte d’Ivoire’s worrying gas supply situation.

Uncertainties surrounding the future volumes of domestic gas supplies has opened up opportunities for LNG import schemes to plug Cote d’Ivoire’s gas deficit. Under a high gas demand scenario, which includes new gas-fired power generation and gas-hungry mines, the deficit could exceed 1,000mcf/d by 2020, equating to LNG demand of over 6.8m t/yr, African Energy’s research shows.

This uncertainty is not uncommon for LNG import schemes, and is a key driver behind opting for an FSRU vessel over land-based options. Despite its confidence in shoring up domestic reserves, the Ivorian government has appetite for LNG, as evidenced by the inclusion of an FSRU vessel in the 2011 Plan National de Développement.

Unless new gas supplies can be sourced, either from significant domestic finds or LNG imports, a limited number of gas-to-power projects are expected in the coming years: the 330MW Grand Bassam OCGT which is to be run off gas supplied from the Gazelle field (although final investment decisions on the plant, gas field, and gas processing terminal are still awaiting, and expected in Q1 15) and Petroci and ContourGlobal’s Abatta CCGT plant (although this project appears stalled until gas supplied can be secured).

According to African Energy’s research, under a worst case installed capacity scenario where Grand Bassam and the Soubré hydroelectric dam are the only new power plants to come online, electricity demand will outstrip the total generation capacity of Côte d’Ivoire’s power plants by 2023.

However, high transmission and distribution losses of 25% mean actual supply will never meet demand. Dwindling gas supplies also mean gas-fired power plants will increasingly be forced to run on distillate diesel oil as backup fuel, significantly raising the cost of production.

Such a deficit, and/or a significant increase in the cost of electricity, will likely hold up development of the mining sector, for which the government holds great hopes as a source of revenue, economic development, and, crucially, electricity demand and as potentially the largest consumer of natural gas.

Either the discovery of new gas or the importation of LNG would result not only in the plugging of a supply gap and a far more positive investment climate for the mining sector, but also the potential for significant electricity exports to neighbouring countries. Plans are already underway to develop Côte d’Ivoire as a regional export hub for electricity, but based on the current trend for the sector, there may be little electricity for one of Africa’s most developed economies to sell.

For further information on our market entry capabilities please contact:

David Slater

Head of Consultancy

t: +44 (0)1424 721667

e: [email protected]