Profile: Reality bites for Dana Gas after hype of 2005 IPO

In depth

Issue 947

- 24 May 2013

| 7 minute read

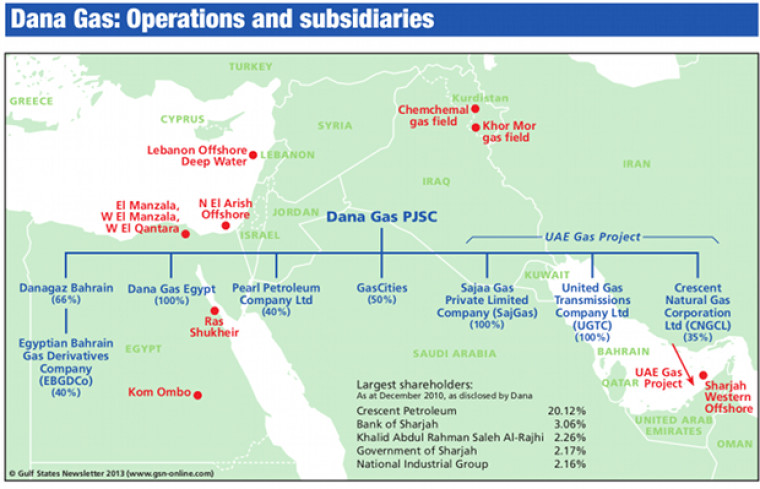

There must have been a collective sigh of relief around the Jafar family dining table on 23 April, when Dana Gas shareholders finally approved a debt refinancing deal, announced late last year after tough negotiations with creditors. Launched to much fanfare in 2005, the Sharjah-based company – founded by Hamid Jafar’s Crescent Petroleum – has faced many hurdles in the past eight years, and its share price has plummeted from the heady days that followed its IPO. In October 2012, Dana failed to settle a five-year $1bn sukuk, after massive payment delays in Egypt and Iraqi Kurdistan. At the end of March, Egypt owed Dana Dh866m ($236m) for gas supplies; in the Kurdistan Regional Government (KRG) area, where it operates in partnership with Crescent and two smaller shareholders, it was owed Dh1, 389m.

Want to read more?

Extra Large Article

£595

(Access to one GSN article)

Don't have an account?

Register for access to our free content

An account also allows you to view selected free articles and set up news alerts.

Register